Investor Spotlight: Analysis of Playa Caracol Investment Opportunity

Investor appetite for coastal real estate is returning to the forefront, as international buyers hunt for yield and long-term appreciation. In uncertain times, beach properties help diversify portfolios while creating long-term value with an investment that also provides a lifestyle choice.

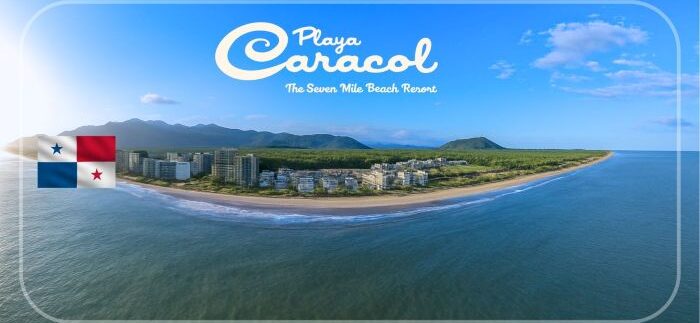

At Punta Pacifica Realty, we talk a lot about the investment potential of Playa Caracol, the seven-mile stretch of white-sand beach about 70 minutes from Panama City. With easy transportation, top-tier developers, and a spectacular coastal location, it has all the ingredients for investing in an early-stage, international-level beach destination.

To take our research a step further, we recently sought to analyze Playa Caracol purely as an investment opportunity. We gathered recent reports, market trends, and used different AI to determine if this is a good time to buy in Playa Caracol, based on common investment metrics. In addition, the study focused on the potential of beachfront property as an investment in turbulent international market conditions.

The conclusion:

Playa Caracol and the Chame district are a clear example of how an emerging beachfront submarket can meet the metrics investors care about: demographic tailwinds, attractive cash yields today, and upside for long-term capital appreciation. Panama’s stable, dollarized economy, rebound in tourism and economic activity also add to the compelling case.

The analysis illustrates that Playa Caracol is a market with key elements in place for investors.

Demographics and demand: growing tourism, expat flows, and proximity to capital

Panama’s visitor numbers have recovered strongly from the pandemic; recent reporting and data show international arrivals rising in recent years and handily exceeding pre-pandemic volumes, underscoring renewed travel demand to Panamanian beach destinations. More than 2.78 million international travelers visited Panama in 2024, the country’s highest on record. At the same time, foreign business interest remains steady, and government visa programs continue to attract foreign buyers and long-stay tourists.

For beachfront assets, the combination of growing tourist arrivals and a steady flow of expatriates creates a two-tier demand pool (short-term vacationers + longer-term renters/second-home buyers).

Return on capital: real short-term rental math in Chame/Playa Caracol

Data for the Chame/Playa Caracol micro-market show real-world short-term rental performance that supports buyer returns. Let’s use data produced by AirROI, a firm that tracks short-term rentals. Market analytics for Chame report an average daily rate (ADR) near US$150 and an occupancy around 31–32%, with median annual short-term revenue in the mid-$14k range for many listings (which likely reflects a small pool of listings).

Homes in Playa Caracol commonly list at $195k–$300k for 2-bed units and townhomes. Using a conservative example — a $260,000 purchase, ADR $150 and 31.7% occupancy — yields roughly $17,356 in gross annual short-term revenue, or about a 6.7% gross yield before expenses (management, taxes, maintenance), according to AirROI’s data. [For the record, results will vary, and some may view these numbers as conservative, long-term.]

That level of gross yield is consistent with reported national averages for Panama (mid-single to high-single percent gross yields) and looks attractive compared with many mature coastal markets where entry prices compress cash returns.

Long-term appreciation: emerging inventory and infrastructure upside

Capital appreciation is harder to time, but three structural points favor upside in Playa Caracol:

- Proximity to Panama City (drives weekend demand and quicker absorption).

- Constrained beachfront inventory with new residential projects (condos, townhomes) that professionalize the market.

- Panama’s broader economic recovery and medium-term growth projections support real estate demand.

Panama’s macro outlook is improving after a mid-2024 slowdown, and multilateral forecasts point to renewed GDP growth, which historically correlates with stronger real estate markets over a multi-year horizon. Markets with reasonable entry pricing today (many Playa Caracol units list well below comparable beachfront luxury markets) provide an asymmetric upside with potential near-term cash yields and capital gains as the corridor matures.

Bottom line

For international investors seeking a blend of cash yield and capital appreciation in a dollarized, tourism-anchored market, Playa Caracol and the Chame corridor present an appealing risk/return profile today: accessible entry prices, demonstrable short-term rental performance that supports mid-single-digit gross yields, and structural demand drivers tied to Panama’s tourism rebound and expat-friendly policies. For buyers who run conservative, expense-aware models (and perform local legal/tax due diligence), now is a defensible window to acquire beachfront inventory before the market fully matures.